At least once a week on Quora or by email, UX designers (usually product designers) ask me about user research. In particular, they always want to know one thing: how to perform “good enough” user research with no access to the end-users.

It’s crazy how prevalent this issue is.

I’ve been there myself countless times in the past. From my own experience and what these designers describe, it would come down to one or a few of the following factors:

- Lack of time, lack of budget.

- Contractual restrictions. For example, sensitive user and financial data, security standards, and anything else covered by non-disclosure agreements (NDAs). It’s a prevalent issue when dealing with government contracts, sensitive and highest security projects, etc.

- Uninformed stakeholders. You know, the ones who haven’t experienced the power of user research first hand, or can’t fathom its ROI.

- Hard or practically impossible to access users or customers. For example, the offshore oil rig engineers*, who work in some of the most dangerous environments. They face strict shifts and have no time or incentives to talk to you. Even remotely.

*I’ll use this as a case to illustrate the following research without access to the users’ case study.

Depending on the organization you’re a part of you might need to make do without the proper user research. It all comes down to said organization’s design maturity, agility, org structure, project and client types, etc.

And so, sometimes you might be able to run weeks of discovery work, consisting of in-depth user research and stakeholder workshops. In other projects, you’ll be forced to produce UI design with just a hint of UX.

The former is excellent and welcoming. The latter is subpar and tends to result in too many professional pain points.

Either way, this article will give a handful of ideas on how to do the best you can, even if facing those limits. We will take a few simple yet effective methods to capture enough insight to get started on the right path.

Setting the expectations

Before sharing those methods, there’s a need to set some expectations. Let’s face it; there are things that only in-depth user research can achieve. And if you use this article a substitute to proper discovery work, you’ll get burned sooner or later.

Instead, by using this guide, you’ll be able to:

- Outline high-level user archetypes, segments, and proto-personas.

- Map necessary journeys, capturing: key touchpoints, dependencies, pain points, qualitative insights, and high-level opportunities.

- Capture the holistic experience overview and services that help support the end-user experience.

- Come up with a basic set of hypotheses for further research, ideations, design, and build efforts.

The methods and what you can get out of it

To make this effort time and cost-efficient, we’ll consider a few ways to perform background user research without access to the end-users by using:

1. Readily available niche online content

For example, Google search sourced industry, niche, process or product-related articles, Youtube videos, easily discoverable user reviews on social media, etc. You can find specific process outlines, personal experiences (e.g., oil and gas case below has some hands-on specialist blogs) and more. The best part? It’s all available immediately.

2. Industry reports on trends

For example, eMarketer reports or agency/consultancy published and publicly available reports on the industry, niche, process, up and coming innovation, and more. While they usually lack the context necessary to draw themes out, these reports can help identify the fundamental problems the industry and specialists inside it face. It’s a good primer for what’s to come. Most of the quality reports can be pricey. However, there are plenty of free resources around.

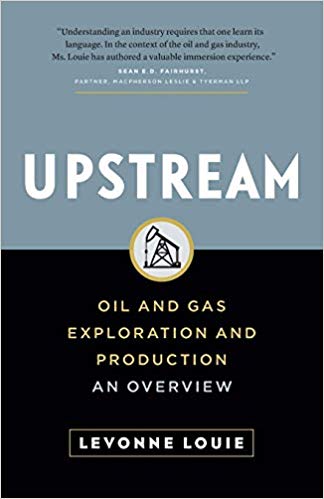

3. Niche books

If you’re out to work on a project (any project really, but especially in a new industry), you should be reading every book on the subject possible. What we are looking for is a high level as well as first-hand experiences that can help inform future methods. I usually buy at least 2-3 books on any subject I’m supposed to work on – with user research included or without. For example, in the past few months, I’ve crunched tens of books on open data, learning behaviours, upstream oil and gas, mineral rights, etc. All highly complex, technical, and unique environments. Working with highly specialized (e.g., oil and gas industry case below), machine learning, big data, and AI subjects this is the only way to be relevant and survive. If you can find a book that outlines crucial dependencies and challenges, you can start experience mapping most of it.

4. Remote, targeted, and free qualitative user input.

This method is by far the most revolutionary approach to user research without direct access to the end-users. A simple dip in the crowdsourced qualitative answers on Quora is the easiest way to dig deeper into the day-to-day and specific scenarios. Better yet, tools like that allow you can target particular people in particular industries, firms, and niches. It’s a truly magical place when it comes to getting actual qualitative input. You can follow up with more questions when looking for more insight. The information then can be used to update the experience map with new ideas. Furthermore, you can start adding high-level criteria to user groups/segments or proto-personas. For the best examples of such outcomes see the below oil and gas case.

The case in hand: Upstream Oil and Gas Discovery and Exploration process mapping

Now that you know why each of the methods is selected, let’s go bit by bit using Upstream Oil & Gas exploration case as the one to explore. I’ll share the key steps I took and the key sources used for the suitable material.

Method 1: Readily available niche online content

Starting point:

Google search: “upstream oil and gas“, “wellsite engineering”, “upstream oil discovery“, “offshore well drilling“, “oil drilling operations“, “seismic data“, “mineral rights“, etc. The more specific, technical and industry lingo the better the results. I usually aim to find personal blogs and independent sources first.

Example technical articles, reports and first-hand experience logs found:

- Human decision-making under uncertainty in the upstream oil and gas industry – source

- Good International Petroleum Industry Practices – source

- Guideline for mineral exploration drilling; drilling and integrity of petroleum exploration and production wells – source

- Well SS 25 – Blowout report presentation – source

- Basic Mud Logging – source

- Oil & gas industry overview – source

- Oil and gas industry lifecycle for a non-technical audience – source

- Fracture gradient prediction: an overview and an improved method – source

- Drilling and geology – source

- Examples of various kinds of drilling rigs presentation – source

- Understanding and assessing well integrity relative to wellbore stray gas intrusion issues – source

- A Crossplot for Mud Logging Interpretation of Unconventional Gas Shale Reservoirs and its Application – source

- The history of the European oil and gas industry – source

- Risk-based process safety for upstream oil & gas – source

- Overview of the oil and gas exploration and production process – source

- Applications of nanotechnology for upstream oil and gas industry – source

- Oil field safety presentation – 4 corners safety – source

and many more.

Most of these sources are informal reports and presentations prepared and shared by geologists, drilling and wellsite engineers and other people directly involved in discovery, assessment, planning and production stages.

Method 2: Industry reports on trends

Starting point:

Google search: “industry report oil and gas“, “drones, 3d printing, big data and Ai in oil and gas“, “oil and gas disruption“, “big 4 oil and gas“, “oil and gas industry trends“, etc. The more specific, technical and industry lingo the better the results. You might also need to identify the specific brands that could have published thought leadership reports, e.g. “Shell 2019 industry trends“

Examples of useful sources found:

Oil & gas term glossary sheet – source: OGUK

Variety of technical safety-oriented infographics – source: Google images

Variety of industry emerging tech and disruption reports – source: Infosys, IBM, MEED, Youtube, etc.

Method 3: Niche books

Starting point:

- Goodreads: social network for avid readers. Plenty of books that can be found by simply searching. The platform also gives recommendations and what people who read about the topic also picked to read next.

- Amazon: simply searching for ‘upstream oil and gas‘ brings up plenty of books to add in a shopping cart. Because books are a bargain I select a random few and checkout immediately. You can start your research very next day.

One thing to look out for is self-published, independent writers (easy to spot) because they usually have the first-hand experience in the industry and can give qualitative take on how things are run.

Example books read:

Upstream: Oil and Gas Exploration and Production: An Overview by Levonne Louie – Amazon link

A rather technical overview of the industry and an A-Z take on exploration and production for crude oil and gas. The book helped me outline the key people and responsibilities involved along the way, high-level journeys, pain points, KPIs, technology, dependencies, natural and political challenges and much more.

Mineral Land Rights: What You Need to Know by Levonne Louie – Amazon link

Just like the previous book, this one was the more political and logistical take on land acquisition, exploration, dealing with a variety of other factors when it comes to assuring safe, secure and legal oil & gas exploration and production. What surprised me the most is how complex the industry really is. The so-called oil landmen and other roles were defined well enough for it to be mapped out in-depth.

The Hitchhiker’s Guide to the Upstream Oil & Gas Industry: An Introduction for non-technical People by Bernhard W. Seubert – Amazon link

Very similar to the first book, this one covers most steps of the oil and gas industry, but with even more detail. I was able to validate the data mapped from the first book as well as add extra insights, especially when it came to pain points and opportunities for improvements. After reading both books I fell in love with the true complexity of the subject and got inspired to investigate deeper.

Fire on the Horizon by Tom Shroder, John Konrad – Amazon link

This was the last book that I read purely from the fascination with the safety side of the industry. It’s surprising how well the oil & gas industry adapted after the upstream 2010 disaster. because of very detailed first-hand accounts, I was able to map many more existing processes, tech dependencies and personal pain points specialists faced and still experience today.

Method 4: Remote, targeted and free qualitative input

Starting point:

Quora: Simply create an account (if you don’t have one yet). Hit the ‘ask question’ button and ask a specific question you’d normally as the end-user. The specialist on the other end usually adds plenty of contexts so you don’t have to file 20 different questions on their day-to-day scenarios. If the question is good and you picked the right people to get the answer you’ll get plenty of valuable input.

Here’s a simple flow on how to do it:

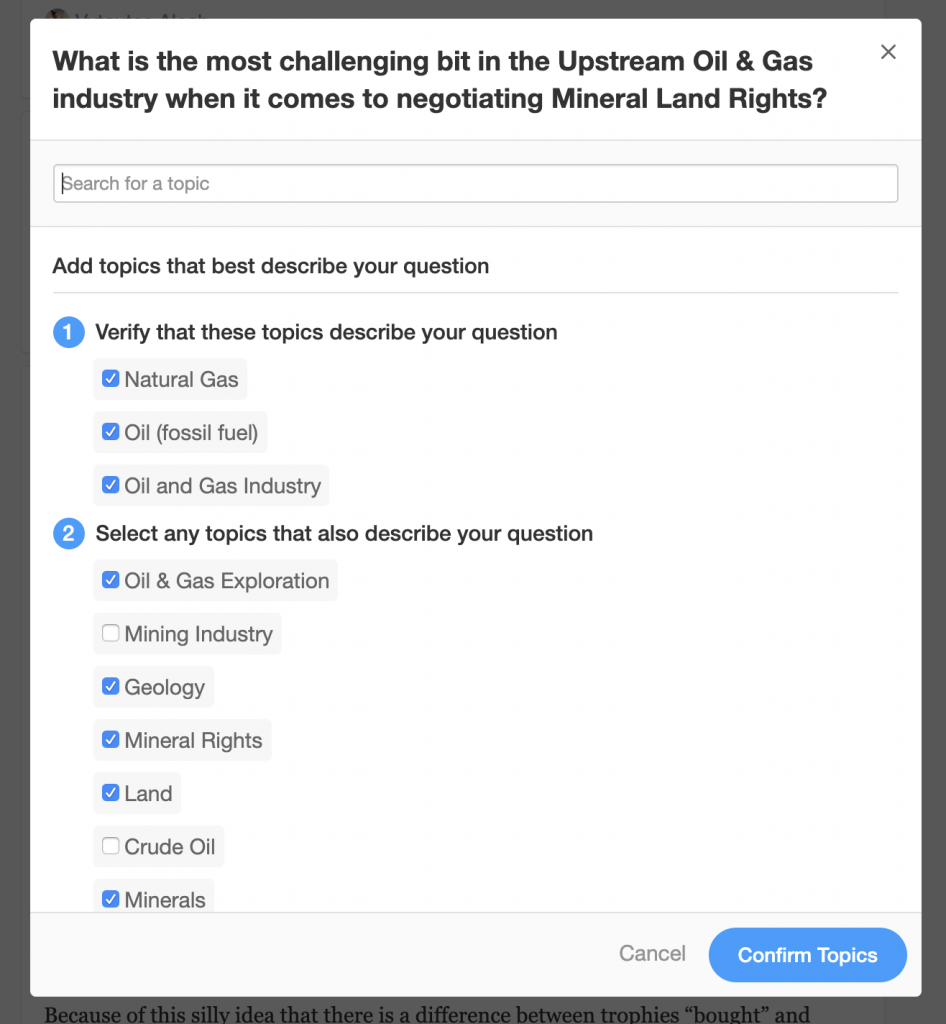

Step 1 – Ask a specific contextual question

Step 2 – Pick the topics that describe the context best

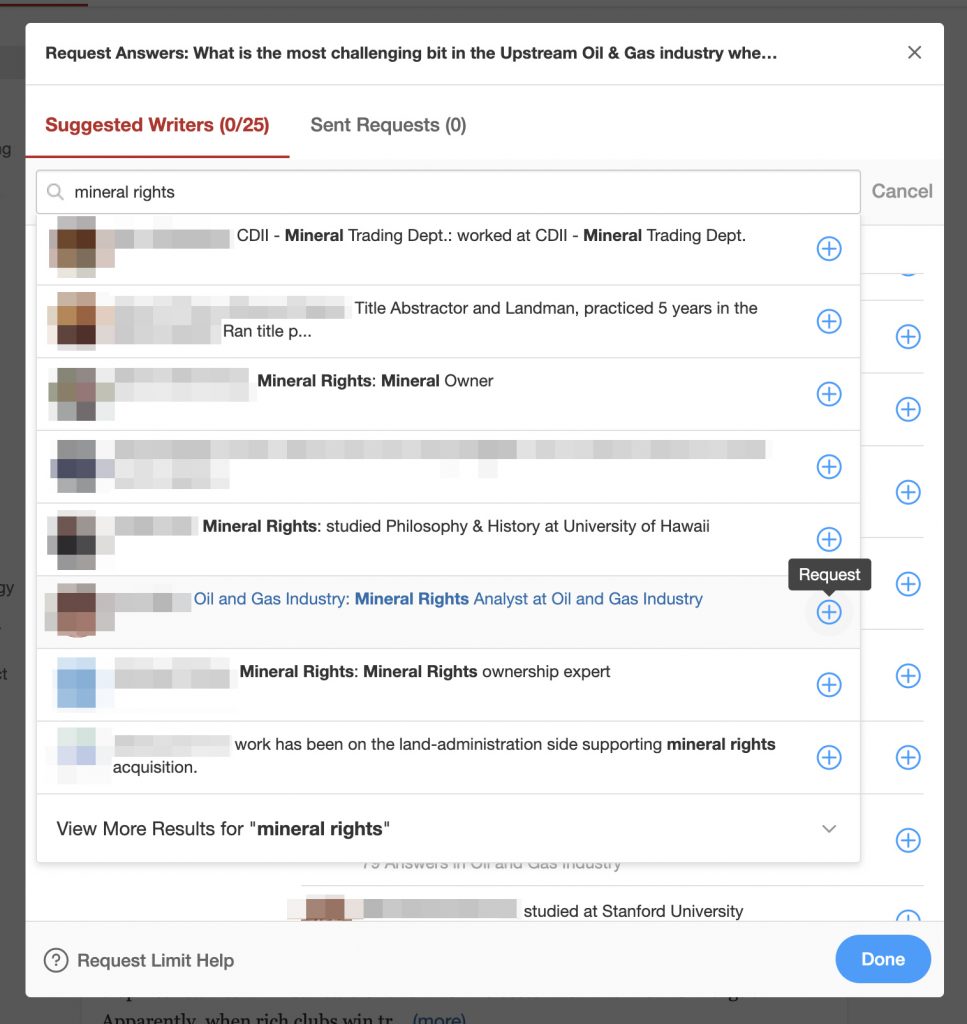

Step 3 – Search, filter and select the right expert to request and answer

It takes on average a few days for answers to start trickling in. For this case, I fired up around 10 different questions. While most of them generate user input, the best performing questions always touched some of the initially discovered (from the books) hypotheses on painful areas.

Example qualitative answers I received wondering about offshore wellsite day-to-day:

Other sample questions with qualitative input:

- What is the best way to decide where to drill for oil/gas? – source

- How can oil drilling be made more efficient? – source

- What should I keep in mind when drilling for oil? – source

- What are the key challenges do geologists face in the Upstream Oil & Gas industry? – source

- What are the key challenges Oil & Gas companies (and individual specialists) face when acquiring mineral and land rights? – source

- How do scientists know exactly where to look for oil and gas? – source

- What Are Some of the Key Challenges in the Supply Chain the Upstream Oil&Gas Companies Face? – source

and many more.

The process and the outcomes

All of the methods were run consecutively and then depending on the specific area dug more in-depth. In this case, I’ve captured and extracted the themes over time.

At a basic level, one should dedicate a couple of days or weeks of active research. I’ve seen colleagues spending their lunches, free time, commutes to work on research like this. Additionally, one would need a weekend or so to put all the themes into an actionable and usable format.

How would I use this data going forward?

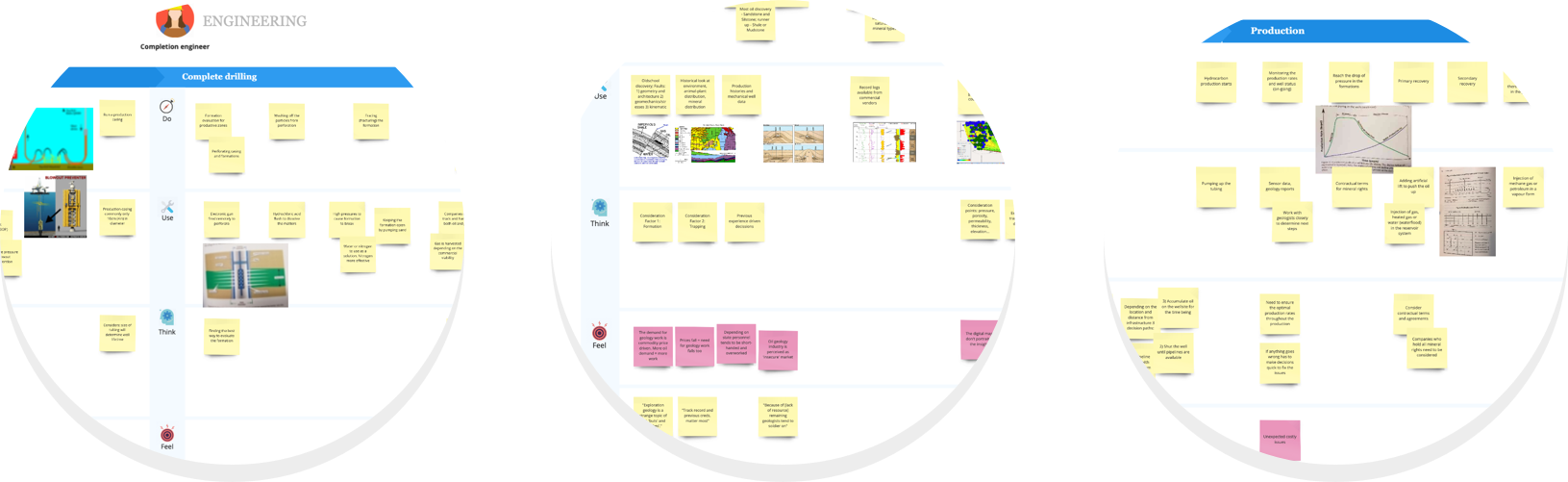

Using exploratory approach, I was able to capture some meaningful and actionable information. In particular, critical steps, dependencies, pain points, quotes, and opportunities, even specific screenshots of what users see while operating data-driven tools.

And so, even without proper user research done, my team would have a starting point for up and coming industry work. They would be able to validate the customer/user experiences with the stakeholders further and get buy-in for proper research work. Additionally, knowing what problems they face can enhance ideations and Lean product design efforts to come.

Discovered systems and user experience knowledge hand over – loads of sketches and diagram to illustrate complex process steps visually:

In the upstream oil & gas exploration case, the team got a solid foundation to start planning more focused user research and design sprint work to follow. We had enough material to come up with hypotheses for up and coming oil & gas industry projects.